Irs Withholding Schedule 2024 – If you didn’t receive a tax refund last year, you’re in the minority. During the 2023 tax season, which dealt with 2022 tax returns, 64% of returns filed by April 21, 2023, resulted in a refund. But . However, they get less control over their work schedule then report to the IRS. In contrast, 1099 contractors are responsible for making estimated tax payments quarterly since their income doesn’t .

Irs Withholding Schedule 2024

Source : www.patriotsoftware.comPublication 505 (2023), Tax Withholding and Estimated Tax

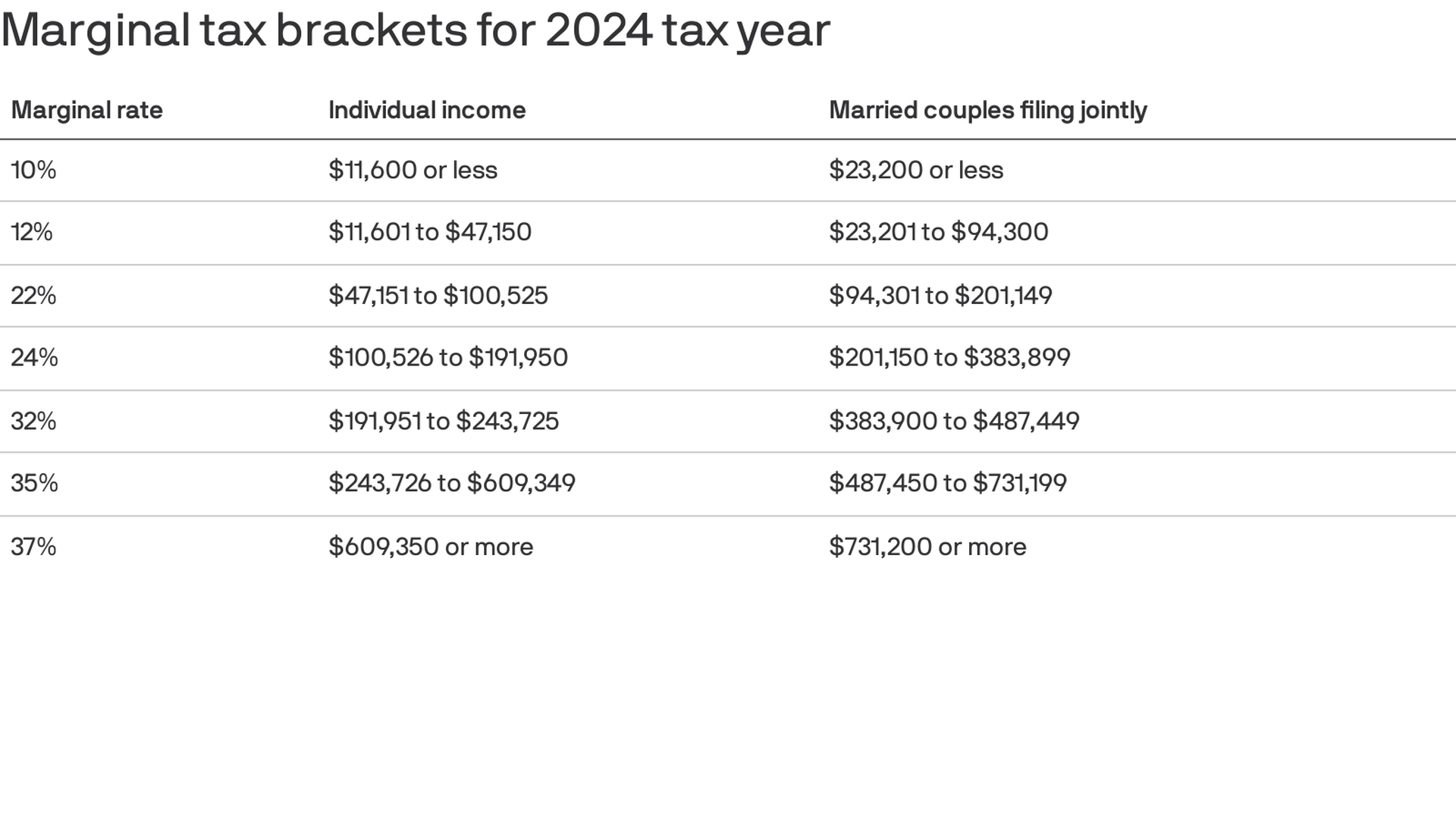

Source : www.irs.gov2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

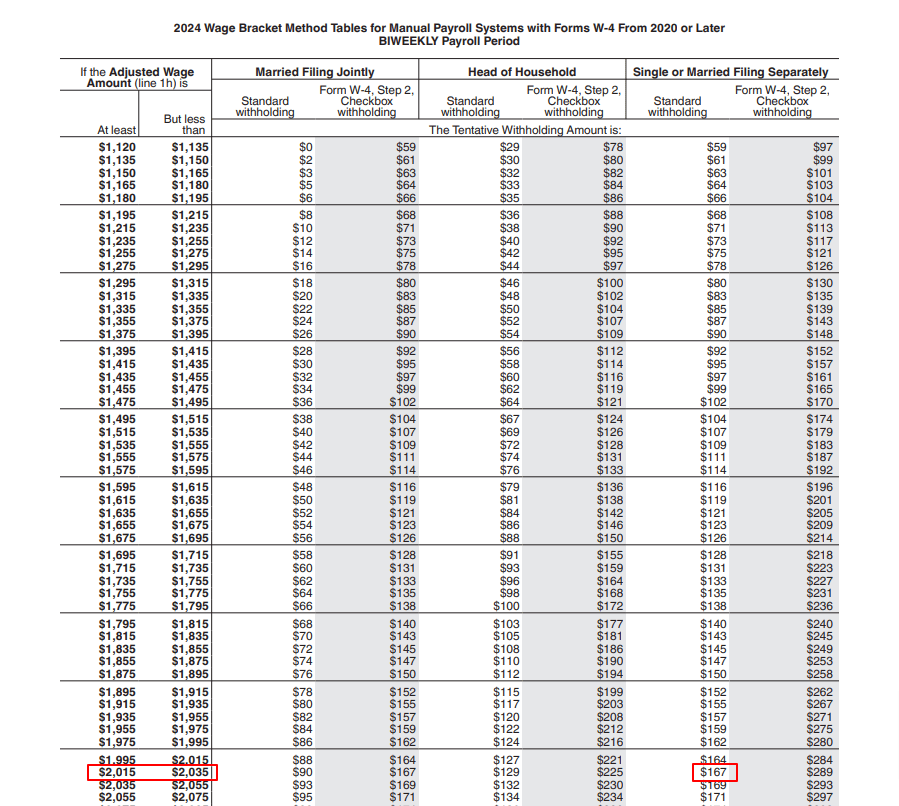

Source : thecollegeinvestor.comIRS Releases 2024 Tables That Will Be Available in Publication 15 T

Source : www.payroll.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com2024 Publication 15 T

Source : www.irs.govIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIRS Tax Brackets 2024, Federal Income Tax Tables, Inflation Adjustment

Source : www.nalandaopenuniversity.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIrs Withholding Schedule 2024 Updated Income Tax Withholding Tables for 2024: A Guide: It’s an unusual time of year for people who pay attention to their taxes—possibly catching you with two goals in mind. On the one hand, you’re worried about preparing and filing your tax return for . Tax season is unavoidable, so there is little excuse not to plan ahead. The biggest hurdle in not paying your taxes on time is simply not knowing when they are due. That being said, when are your 2023 .

]]>