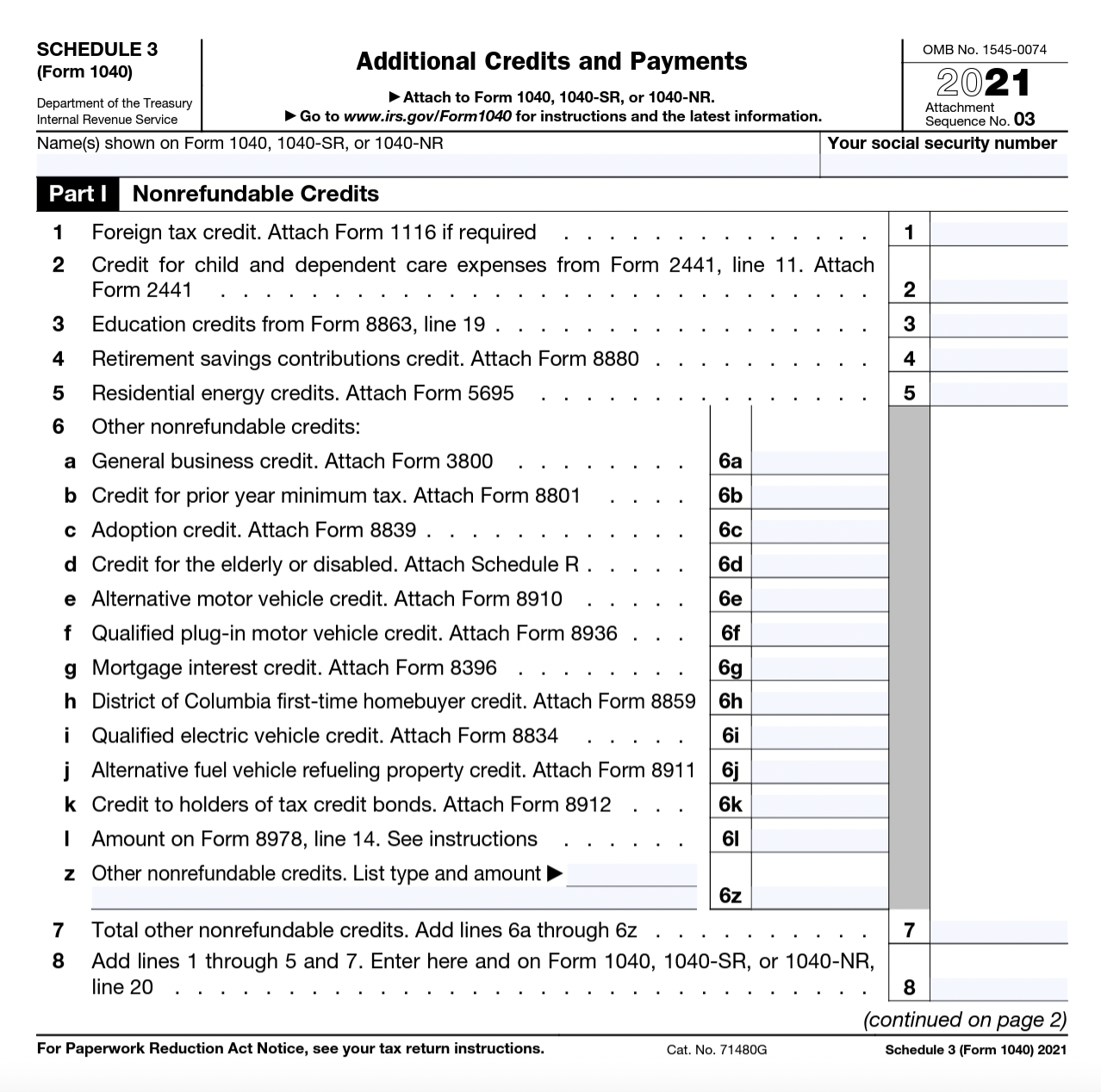

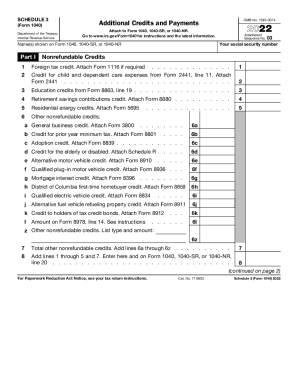

2024 1040 Schedule 3 Form – The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . This guide provides information on the different payroll tax forms and deadlines specific to household employers, helping you navigate the process with ease. .

2024 1040 Schedule 3 Form

Source : www.dochub.comFederal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet

Source : sites.google.com2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comMost commonly requested tax forms | Tuition | ASU

Source : tuition.asu.eduIRS 1040 Schedule 3 2020 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comSchedule 3 2021 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.com1040 Schedule 3 2023 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comIRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

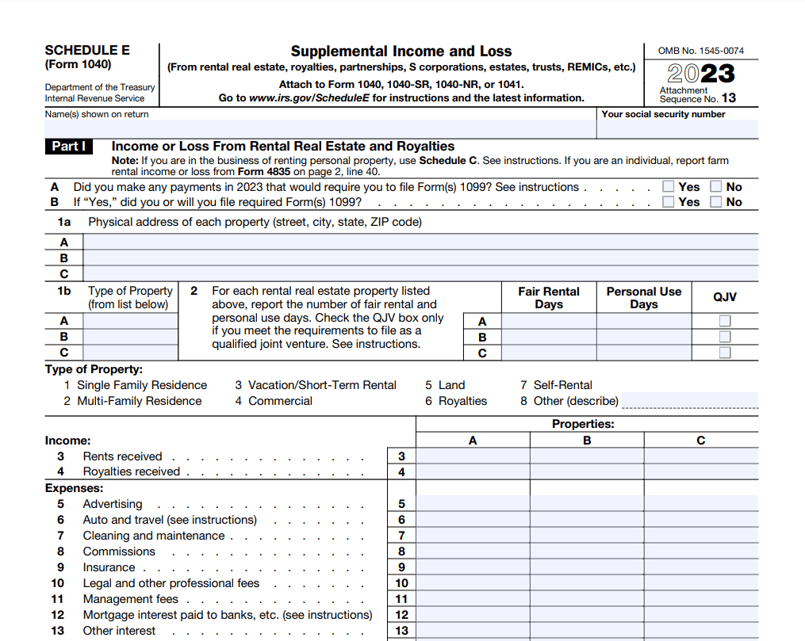

Source : www.uslegalforms.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.com2024 1040 Schedule 3 Form Schedule 3: Fill out & sign online | DocHub: Subtract your cost of goods from Line 3 and Schedule SE to calculate your self-employment taxes. Warnings If your Mary Kay business loses money, report the net loss on your Form 1040 or . You should also write your Line 11 result (the credit itself) on line 49 of Schedule 3 (Form 1040) or on line 47 of Form 1040NR. And that’s Part II finished. Line 11 shows you your credit. .

]]>